If you have ever bought anything on eBay, you are probably no stranger to the concept of second-price auctions, the bidding process in which the winner pays the price offered by the second-highest bidder, rather than their own.

The second-price auction model is widely applied in the world of programmatic. For years, it has allowed advertisers to bid high prices to secure impressions, but ultimately pay a much lower price. However, due to recent trends in the AdTech industry, we are witnessing a steady transition to a model similar to the first-price auction. Before we actually trace the roots of this change, let’s discuss the difference between first- and second-price auctions.

The Difference Between First-Price and Second-Price Auctions

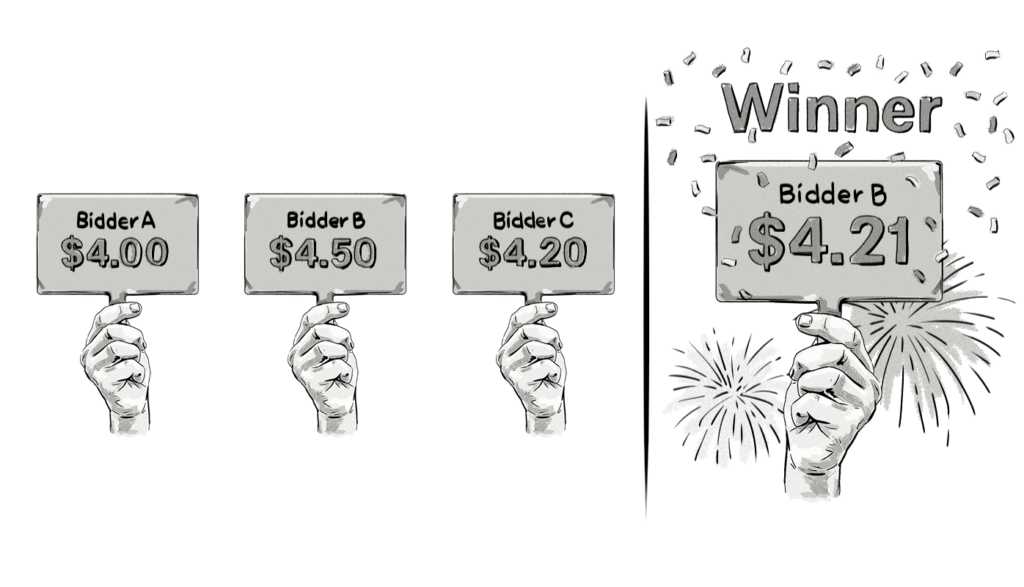

In real-time bidding (RTB), the second-price auction gives the winner a chance to pay a little less than their original submitted offer. Instead of having to pay the full price, the winning bidder pays the price offered by the second-highest bidder plus $0.01. The final price of the impression is known as the clearing price.

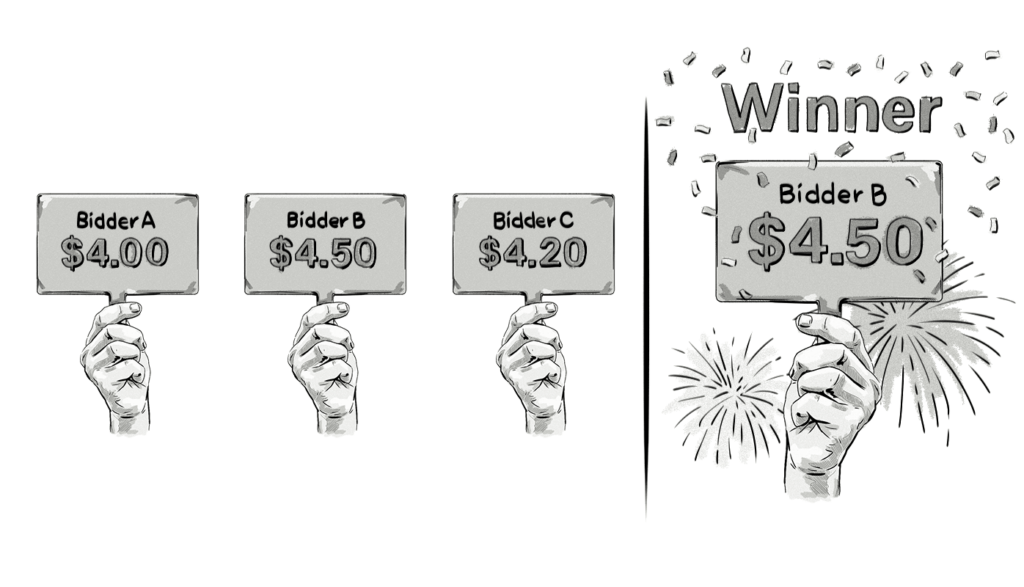

Consider this second-price auction example (how it works on eBay):

Bidder A = $4

Bidder B = $4.50

Bidder C = $4.20

The outcome:

Bidder B wins and gets the impression for the clearing price of $4.21 (second-highest price + $0.01). The reduction, or consumer surplus, in this example is the $0.29 the winning bidder “saved” on the impression.

The reduction presents an advantage for the bidders and an opportunity to save on overestimation of the value of the impression. Due to various floor optimizations and shenanigans, however, the clean second-price auction model is virtually nonexistent in the world of programmatic media buying.

For comparison, consider this first-price auction example:

Bidder A = $4

Bidder B = $4.50

Bidder C = $4.20

The outcome:

Bidder B wins and gets the impression for $4.50. The first-price auction would require the winner to pay the full price they originally offered in the auction.

In the first-price auction model (also known as an English auction) the bidders pay exactly what they bid. While this auction mechanism gives publishers the highest eCPMs for their inventory, it can lead to unnaturally high prices, as buyers are forced to “guesstimate” how much their competition bid. This, in turn, can lead to overpaying, and a lower demand for that publisher’s inventory.

Hard Price Floor

A hard price floor is the minimum price the publisher will accept for the impressions the ad exchanges. Bids that are below this minimum price are simply discarded. This means sellers will not take any bids below the hard price floor.

Soft Price Floor

Since bidders may not necessarily know what the hard floor is, the concept of a soft price floor was implemented to “catch” the offers that fall only slightly below the hard floor and would otherwise get rejected with no yield for the publisher.

Why the Transition From Second- to First-Price Auctions?

A lack of transparency is commonly cited as one of the main woes of programmatic RTB. Because of certain inconsistencies in the ways various exchanges manage auctions, there is a popular trend towards first-price auctions as an alternative, in a bid to create an even playing field for everyone.

While the mechanics of the second-price auction seem to protect the advertiser, they may actually be hurting the publishers, who have devised an array of methods to artificially inflate the original CPM. This is achieved by introducing soft floors, hard floors, or various other fees and manipulations inflating the final price beyond what the advertiser would originally want to pay. However, these practices basically counter the idea of a second-price auction and convert it into a quasi-first-price auction, which is basically a hybrid between the two.

We Can Help You Build a Header Bidding Solution

Our AdTech development teams can work with you to design, build, and maintain a custom-built header bidding solution for any programmatic advertising channel.

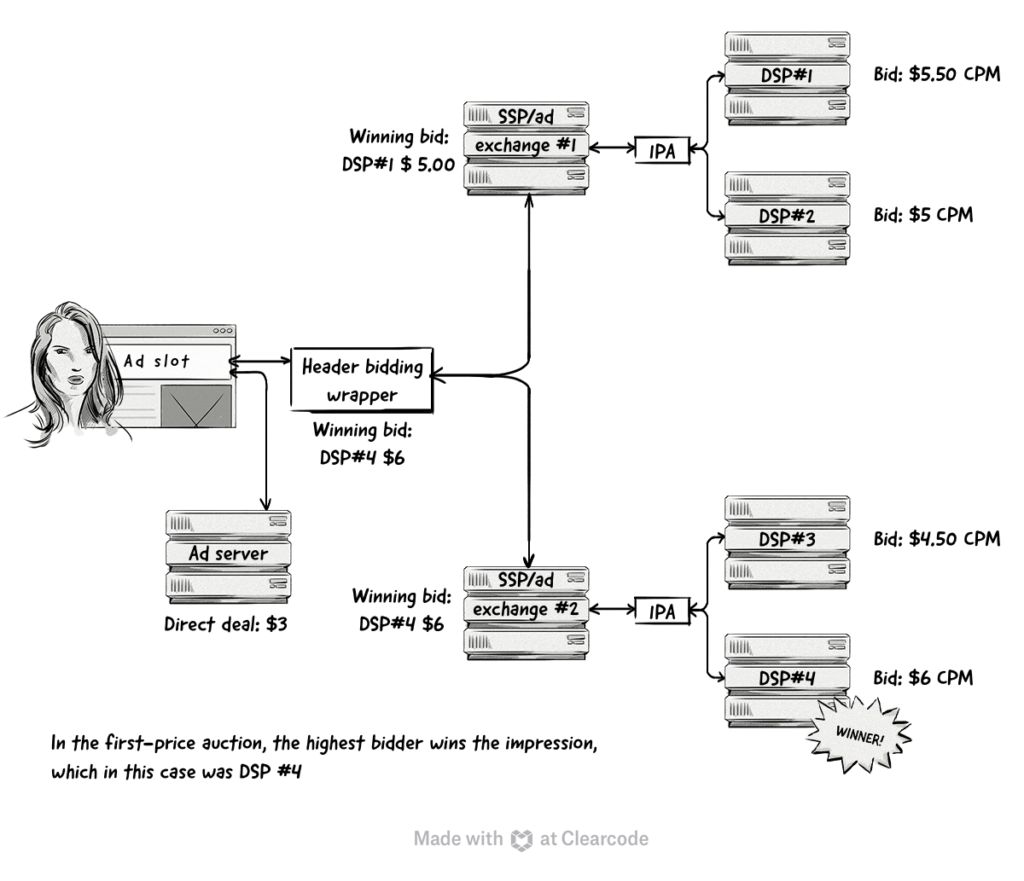

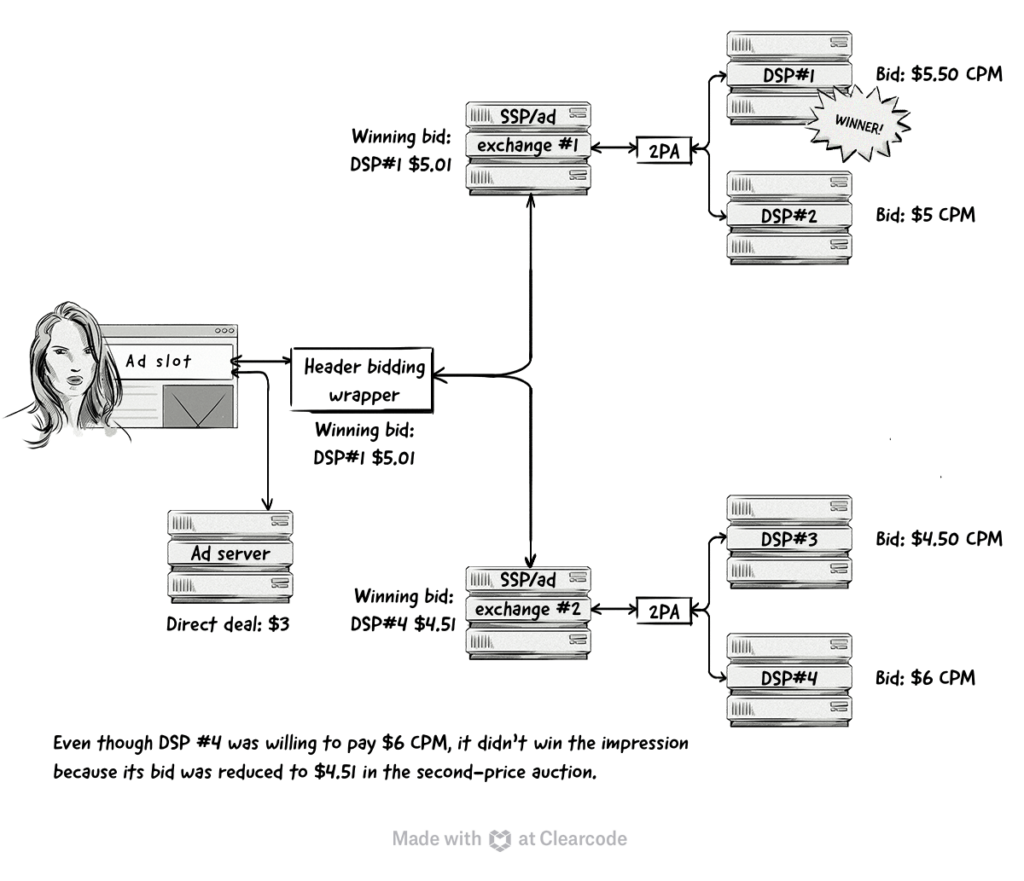

First-Price Auctions Work Better With Header Bidding

Header bidding (aka pre-bidding, advance bidding, and holistic yield management) offers SSPs an opportunity to create a second-price auction before running the final auction in a publisher’s ad server. SSPs conducting a fair second-price auction in the header will hold less competitive bids for the final auction, and end up with very low win rates, which prompts the transition to first-price auctions.

First-price auctions give buyers a better chance at winning the impression when header bidding is conducted, because instead of the winning bid from a second-price auction being pushed to the ad server, their true bid is the one that competes in the final auction.

Compare the following examples.

First-price auction:

Second-price auction:

What First-Price Auctions Mean for the Advertiser

Exchanges offering programmatic ad buying, whether purposefully or not, obscure the bidding process, making it unclear for the buyers which kind of auction they are really dealing with. While the first-price auction seems to be the more transparent option (there are no floor mechanisms or hidden fees), it offers few real benefits for the advertiser. Truthful bidding in this model (i.e. bidding the real value of the impression) may, in fact, not only be much more challenging, but also more expensive.

The first-price auction allows both buyers and sellers to see the actual cost of the impression and the fees taken by the SSP/ad exchange will at least be known. The winning price is exactly what the advertiser agreed on, but there is a risk of overpaying for impressions.

The workings of the first-price auctions make sense economically only when the buyer knows the fair market value of the impressions they are bidding on, and understands the mechanics of hard- and soft-floor mechanisms.

Advertisers don’t like the feeling that they’re manipulated into bidding more than they should, which is exactly why some use algorithms to predict the price floors and bid accordingly. To do this, they will have to invest in technology that will specifically adapt to the rules of every auction.

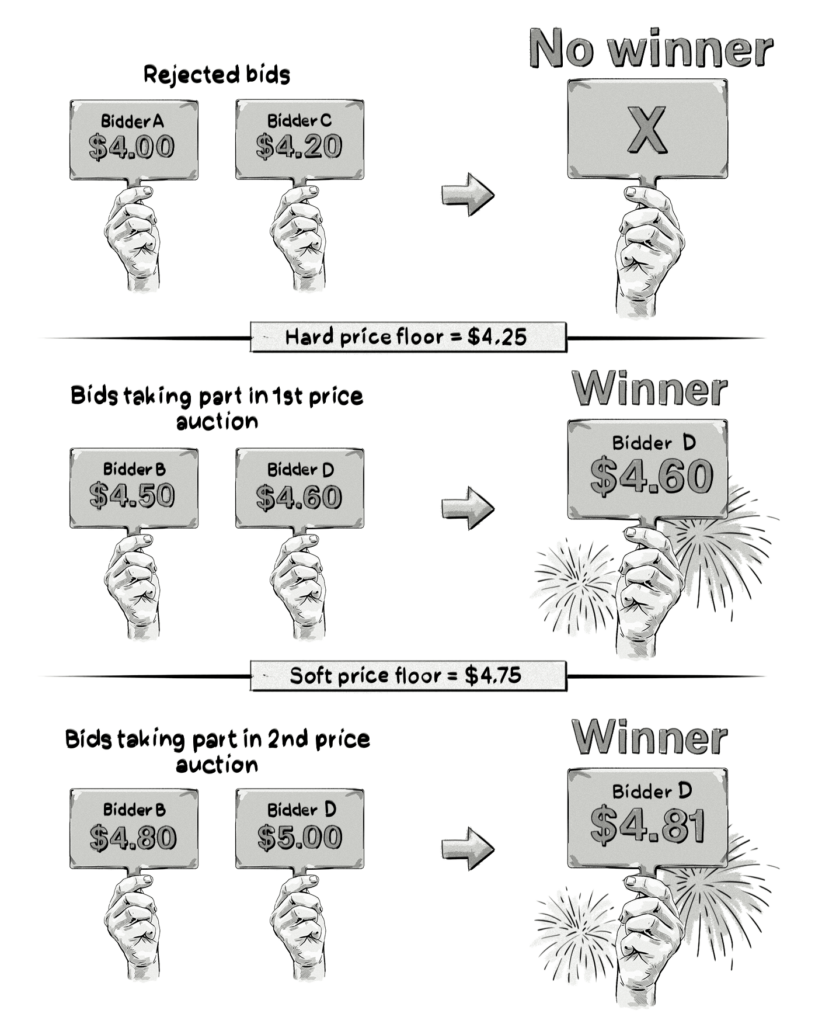

What First-Price Auctions Mean for the Publisher

It’s no surprise that publishers are trying to regain some of the lost revenue caused by the reduction (the difference between the bid price and the clearing price) in second-price auctions. To do this, SSPs and ad exchanges are beginning to implement a combination of soft and hard price floors, essentially converting the auction into a hybrid between first- and second-price auctions.

Consider the example below:

Explanation:

The hard price floor automatically eliminates all the bids under $4.25. The bids between the hard and soft floor take part in first-price auction, unless there are bids above the soft price floor, which will take part in second-price auction instead. This solution seems to offer the best of both worlds; high-value bidders can avoid paying surplus, as they are charged per the second price.

Conversely, in the absence of high-value bidders (no bids above $4.75), the low-value bidders (with bids below the soft price floor) are charged per the first price, thus maximizing the publisher’s yield.

Exchanges implement flooring methods to combat the low bid density. Header bidding further raises the floors, and exchanges are even considering abandoning the auction type altogether. Whether the first-price auction model will, with time, become gamed like the second-price model remains to be seen.

Summary

In his LinkedIn Pulse post, Simon Harris, Head Of Programmatic Activation at Dentsu Aegis Network, aptly points out that it’s a really convenient coincidence that the transition from first- to second-price auctions is happening exactly at a time when there’s increased pressure on SSPs/ad exchanges to reduce their take rates (the fees they apply to the reduction, which is often not known to publishers).

It shows that the shift in programmatic media buying may be happening clearly with the advantage for the publishers.

For the advertisers, on the other hand, it is even more important to understand the mechanics of RTB and be able to bid accordingly.

This may be increasingly difficult without proper machine-learning algorithms in place.

We Can Help You Build a Header Bidding Solution

Our AdTech development teams can work with you to design, build, and maintain a custom-built header bidding solution for any programmatic advertising channel.