In recent years, we have seen a quick proliferation of various universal ID solutions. The companies behind them include some of the leading AdTech vendors, promising a better alternative to cookie syncing, competition with walled gardens like Facebook and Google, and a solution to the end of third-party cookies.

In this blog post, we’ll explain why these universal ID solutions and ID graphs exist, how they work, and the challenges they face.

What Is a Universal ID?

A universal ID, also known as an alternative (alt) ID, is a unique user ID that allows AdTech companies to identify users across different websites and devices. Universal IDs are created using a piece of deterministic data, such as an email address or phone number. A hashed and encrypted ID is then created, allowing companies to identify the individual without exposing the raw data — i.e. email address or phone number.

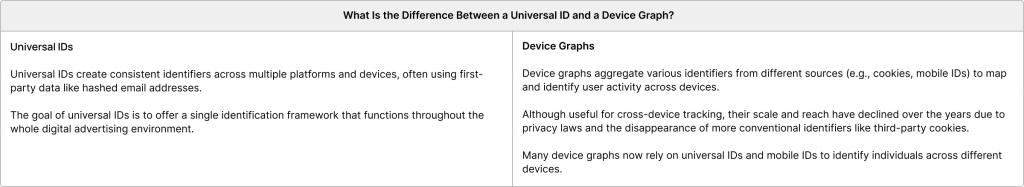

Some universal IDs operate within one environment, such as web browsers, while others aim to identify users across different environments, such web browsers and mobile devices. For the latter, device graphs are used to match together the IDs generated in web browsers with the ones generated in other devices, e.g. mobile IDs in smartphones.

Universal IDs have emerged in response to the end of third-party cookies in major web browsers like Safari and Firefox, and the planned end of third-party cookies in Google Chrome in 2025.

These universal IDs perform the same functions as third-party cookies, but the difference is in how they are created.

We Can Help You Build an AdTech Platform

Our AdTech development teams can work with you to design, build, and maintain a custom-built AdTech platform for any programmatic advertising channel.

Why Does Online Advertising Need an ID Solution?

The need for standardized ID solutions results from a number of problems AdTech faces:

- Being able to identify users as they move around the web is vital for everyone in the online advertising industry

Publishers earn more money on their inventory, advertisers are able to achieve better campaign performance, and AdTech companies can sell their tech.

- Web browsers don’t emit a persistent ID

Mobile devices like smartphones and tablets emit a persistent device ID – it only changes if a user manually resets it. AdTech companies can access this device ID during ad requests for in-app inventory, making it easier for advertisers to identify and target users as they move between apps.

Web browsers (on laptops, desktops and mobile devices) don’t have a persistent ID, which is why AdTech companies create third-party cookies and universal IDs to identify users on different websites.

- Identifying users on web browsers is done via third-party cookies, but they are disappearing

The problem with third-party cookies is that they are increasingly blocked or deleted by ad-blocking software, browser settings (think Apple’s ITP and Firefox’s Enhanced Tracking Protection), manually deleting cookies, or browsing in private/incognito mode.

Also, Google Chrome has announced that it will shut off support for third-party cookies in 2025, meaning that all of the major web browsers will not support third-party cookies in near future.

- Domains other than the one that created the cookies cannot read them

A DSP cannot read or access a cookie set by an SSP, which makes identifying the same user difficult and creates technical complexities when running behavioral and retargeting campaigns.

To solve this problem, AdTech companies use a process known as cookie syncing. This process works by matching the cookie IDs of one AdTech vendor with another.

Read more about cookie syncing here.

- Cookie syncing is a resource-intensive and slow process

Hundreds of web calls are made with every page load, which impacts the website’s speed and the overall user experience.

- Cookie syncing is not always reliable

The match rate of cookie IDs between different AdTech and MarTech platforms typically varies between 40–60%, and as the number of platforms involved in the syncing increases, the match rates decrease.

- Walled gardens like Google and Meta have the advantage of using deterministic data, e.g. login data tied to people-based IDs

Programmatic vendors still rely on cookies, resulting in many advertisers and publishers turning to the walled gardens due to the advantages they offer in terms of identity, tracking and targeting.

- Access to mobile IDs is harder on iOS devices

In June 2020, Apple made changes to how app developers can access a user’s IDFA (ID for advertisers).

Basically, app developers have to ask users to give them access to their device’s IDFA before they can pass it on to their AdTech and mobile measurement partners.

Without the IDFA, AdTech and mobile measurement companies can’t identify individual users. This means they can’t run behavioral targeting or retargeting.

The First Universal ID Solutions

Currently, dozens of universal ID solutions help solve identity issues connected with the end of third-party cookies. But the landscape of universal IDs has evolved over the years. A few years ago, there were various solutions designed to help companies reduce latency caused by the cookie-syncing process.

Let’s take a look at them.

The Trade Desk’s Unified ID 1.0

The Trade Desk, a market-leading demand-side platform (DSP), created its Unified ID 1.0 (UID) to decrease the number of cookie syncs conducted on web pages.

Cookie syncing is necessary because every AdTech vendor uses its own identifier for users, leading to slow page loads and reduced match rates. Unified ID 1.0 aimed to standardize this process by using a single cookie ID across the open web to increase match rates and improve overall efficiency in ad targeting across web and mobile browsers.

The first iteration of this UID used the adserver.org and adsrvr.org domains to power the ID-resolution service across web browser environments (i.e., web and mobile web browsers).

However, Unified ID 1.0 was heavily reliant on third-party cookies, which began to disappear from the AdTech landscape as the industry shifted towards greater user privacy and stricter data protection regulations.

These moves signaled the end of cookie-based tracking and forced the industry to innovate beyond cookie-reliant solutions.

In response, The Trade Desk launched Unified ID 2.0 — the solution designed to work without third-party cookies.

The UID 2.0 creates IDs out of user-provided email addresses. This approach ensures that the identifier is persistent even when third-party cookies are blocked. Read more about UID 2.0 in the section The Universal IDs of Today.

Advertising ID Consortium

The Advertising ID Consortium was an independent group governed by representatives from AdTech companies like Index Exchange, LiveRamp, The Trade Desk and Dataxu, and boasted the support of a number of other ad platforms.

The group utilized cookie IDs (TTD’s Unified ID and DigiTrust’s ID) and their own cookie ID via AppNexus’s domain, as well as people-based identifiers supplied by LiveRamp’s IdentityLink (IDL).

However, due to disagreements about the direction of the ID solution, the Consortium collapsed, and the ID project was closed down.

DigiTrust ID

Launched as a neutral, industry-wide initiative, DigiTrust aimed to standardize and simplify cookie-based user identification. It provided encrypted and standardized IDs to its members, promoting a vendor-agnostic approach.

Despite its neutrality, the project could not survive the decline of third-party cookies and eventually DigiTrust ID was shut down in June 2020.

The Universal IDs of Today

The Trade Desk’s Unified ID 2.0 (UID2)

The Trade Desk launched the successor of the UID 1.0 in July 2020.

The UID2 framework enables deterministic identity for advertising opportunities on the open internet for:

- Advertisers

- Publishers

- Demand-side platforms (DSPs)

- Supply-side platforms (SSPs)

- Single sign-on (SSO) providers

- Customer data platforms (CDPs)

- Consent management providers (CMPs)

- Identity providers

- Third-party data providers

- Measurement providers

Because of the growing decline of third-party cookies in popular web browsers like Safari and Firefox, and soon in Google Chrome, the second iteration replaces the use of third-party cookies with IDs created from encrypted email addresses and phone numbers, i.e., deterministic data.

Watch the video below to learn more:

But using hashed and encrypted email addresses as an ID is only one function of Unified ID 2.0.

During the AdWeek Spotlight Event, The Trade Desk’s CEO, Jeff Green, outlined the four main elements of Unified ID 2.0:

Further reading

More than 200 entities are on the Unified ID 2.0 partners list.

Within the UID 2.0 workflow, there are a couple of key participants — the Core Administrator and Operators. These entities handle different tasks in the UID2 ecosystem.

The Core Administrator is an organization that manages the UID2 Core Service — the service accessing secured data in the UID2 ecosystem. For instance, the Core Administrator provides UID2 operators with encryption keys and salts and notifies operators and DSPs of user opt-out requests. Currently, this is held by The TradeDesk.

Operators manage the Operator Service via the UID2 APIs. This means that they obtain and retain encryption keys and salts from the UID2 Core Service, salt and hash personal data to return raw UID2s, produce UID2 tokens, and distribute decryption keys for these tokens.

The TradeDesk established public and private operators, also named open and closed operators.

Open operators run public instances of the Operator Service and deliver them to all relevant UID2 participants. However, the demand for UID2 public operators has been low, so many operators of UID 2.0 are private.

Private operators run an internal version of the UID2 service. They only use their own tech stack to process and hash first-party data — either from themselves or from clients — to create UID2 IDs.

The TradeDesk integrated with several prominent entities in this area, such as IPG, Paramount, Disney, Optable, Salesforce, Adobe, Snowflake and Amazon Web Services.

Here’s the overview of how UID2’s ecosystem works:

Further reading

- Working Together to Support UID2 – IAB TECH LAB

- Unified ID 2.0 Faces Roadblocks In Europe As A Result Of GDPR – AdExchanger

- AdExchanger’s Regularly Updated Guide To UID 2.0 – AdExchanger

- Unified ID 2.0 Overview – Unified ID 2.0

ID5

ID5 is an independent identity provider that allows publishers, data providers and AdTech companies to run addressable and measurable advertising campaigns.

In July 2019, ID5 announced that its identity solution is available in Prebid.js, allowing publishers and AdTech vendors to utilize the ID in header-bidding auctions.

The company partnered with many ad agencies, SSPs, AdTech vendors, including brands such as OpenX, The TradeDesk, and TransUnion.

ID5’s goal is to build an identity infrastructure to power addressable advertising across different channels, e.g. web/display (web browsers), in-app mobile and CTV. The company processes around 10 billion signals a day and also offers a device graph, which can be licensed, and an SDK for in-app mobile.

Compared to other universal ID solutions (e.g. Unified ID 2.0), ID5 can create an ID based on both deterministic and probabilistic data.

ID5 claims to be the most common and persistent ID present in programmatic transactions.

Secure Web Addressability Network (SWAN)

The Secure Web Addressability Network (SWAN), aka SWAN.community, is another ID solution that is very similar to UID2, but with a few differences.

Here are the main things you need to know:

- SWAN is open sourced and decentralized.

- SWAN will produce an ID, called Secure Web ID (SWID).

- To use SWAN, publishers and consent management platforms (CMPs) will need to work with at least one SWAN Operator (more on this below).

- Users run an audit to see which companies have handled their data.

- The main companies behind SWAN.community are Zeta Global, 51Degrees, Open X, ENGINE Media Exchange (EMX), PubMatic, Rich Audience and Sirdata.

The SWAN Ecosystem

SWAN runs inside the SWAN Ecosystem, which is made up of SWAN Operators and SWAN Senders and Receivers.

- SWAN Operators — companies that will facilitate the use of SWAN Data by publishers within the SWAN Network.

- SWAN Senders and Receivers — companies that will use the pseudonymous identifiers for identifying users and their preferences during transactions (i.e. media-buying processes). During transactions, SWAN data is sent from the Sender to the Receiver. To provide transparency, the transactions must be cryptographically signed by the Sender and the Receiver.

How Does SWAN Work?

When an Internet user visits a website using SWAN for the first time, they’ll be presented with a consent box (example below) where the user can reset their SWID, opt in to personalized advertising (optional), and provide their email address (optional).

If a user does provide their email address, then it can be used with other ID solutions that generate IDs via hashed email addresses, such as UID2.

Once a user has updated their preferences, the information will be passed to SWAN Operators who will then update the user’s preferences across the SWAN Ecosystem.

The SWID will be stored in a first-party cookie and can be used for ad targeting, frequency capping, measurement, and attribution.

Once a user has selected their preferences, they won’t be shown the consent box again on websites using SWAN. Users can also update their preferences at any time on any website participating in SWAN and will be updated across the SWAN Network.

Source: swan.community

Further reading

This SWAN initiative is not to be confused with the SWAN (Storage With Access Negotiation) proposal that was put forward by 1PlusX in the W3C Business Group as part of Google’s Privacy Sandbox initiative.

Flashtalking Identity Management

Flashtalking, a leading ad-management and analytics-technology company, also offers a solution to the ID problem with FTrack.

FTrack is a cookie-less tracking solution that incorporates data from different devices and across the web and mobile apps. The result is a probabilistic ID that can be used to not only target audiences, but also to attribute conversions to campaigns.

Other examples of companies offering ID resolution services include LiveIntent, and Throtle, lifesight, Navatiq, and Adara.

ID Solutions and ID Graphs

In addition to the ID solutions listed above, many of the top data platform vendors have also released their own universal ID solutions.

The main difference between these solutions and the ones above is that they are connected to a ID graph, allowing companies — primarily, advertisers, AdTech companies and publishers — to identify individuals across different devices, rather than just across different websites.

LiveRamp

LiveRamp is a company offering many data-related services, including first-party data onboarding and ID resolution.

RampID is LiveRamp’s advanced identity resolution solution, designed to provide a persistent and privacy-compliant way to identify users across devices and channels.

RampID integrates both first-party and third-party data to create a comprehensive and persistent user identity. It uses deterministic data sources, such as email addresses and phone numbers, ensuring high accuracy and stability.

It maps user interactions across various touchpoints, including mobile, desktop, and offline environments, allowing marketers to maintain consistent and personalized communications with their audience.

Tapad

Tapad is another global leader in the ID graph and resolution space.

The Tapad Graph allows marketers to run cross-device ad targeting, personalization, and attribution by identifying users on an individual and household level and creating a single customer view.

In February 2021, Tapad released a new product called Switchboard, which aims to provide interoperability to all the cookieless IDs (e.g. first-party cookies, mobile IDs, and CTV IDs) that will replace third-party cookies.

Tapad’s Switchboard product facilitates interoperability among various identity solutions, and by using machine learning and probabilistic matching, it helps connect first-party cookies, mobile IDs, and other identifiers in a cookieless world

Neustar

Neustar, part of TransUnion, developed TruAudience, an identity graph solution for omnichannel marketing. The product enhances media performance with next generation identity resolution capabilities.

Powered by Snowflake, TruAudience receives and integrates data from various channels, creating a single, cohesive view of each customer. It links fragmented data using a persistent ID that incorporates the richest set of historical and up-to-date attributes and identifiers for over 250 million individuals. This includes traditional identifiers like addresses, emails, and phone numbers, as well as digital identifiers such as IP addresses and Mobile Ad IDs.

TrueAudience provides a holistic view of customer interactions across all channels and touchpoints.

Epsilon

Epsilon is a digital marketing and data company that was purchased by Publicis Group in April 2019. Epsilon operates an ID graph that relies on cookies and mobile IDs, but it also has its own ID — its CORE ID.

Epsilon’s CORE ID is an identity resolution solution that enables publishers and advertisers to create a unified and detailed view of their audience. Built on deterministic data, particularly offline identifiers like name and address, CORE ID offers accuracy in mapping consumer identities across various touchpoints.

Zeotap

Zeotap is a customer intelligence platform that allows brands and publishers to connect their CRM data with IDs in Zeotap’s ID+.

The product works across both web and app properties on both mobile and desktop devices by linking a universal ID to every customer profile in Zeotap’s CDP.

ID+ is scalable and interoperable. Built on top of a deterministic identity graph, it connects with all other identifiers.

How Do ID Graphs Work?

ID graphs have been around for a number of years, but they are starting to really take off.

The reason for the increase in popularity stems from the identity challenges mentioned above.

Because the main identification mechanism (i.e. third-party cookies) is becoming less and less available, there’s a need to look for other ways to identify users across not only websites but also other devices like mobile and CTV.

And that’s where ID graphs come in.

By collecting multiple IDs from different channels, ID graphs can create a single customer view (SCV), which consists of an individual’s behavior and data points across multiple devices and channels.

Below is an example a single customer view from Piwik PRO’s customer data platform (CDP):

Source: Piwik PRO

Here’s an overview of how most ID graphs work:

Here’s an explanation of how ID graphs work:

Step 1. Data collection: A company would send its customer IDs (i.e. first-party IDs) to the ID graph. These first-party IDs could be taken from websites, mobile apps, and customer and data platforms (e.g. CRMs, CDPs, and DMPs).

Step 2. Match the customer IDs with the IDs in the graph: The company’s first-party IDs would then be matched with all the other IDs in the graph, which would be done using a combination of deterministic and probabilistic matching.

Step 3. Activate the data for cross-device activities: The company can now identify their customers across different devices and channels and run various cross-device activities, like ad targeting, personalization, and attribution.

Looking at building an ID graph?

We partnered with AWS to build an ID graph using AWS Neptune. Read about it here or contact us to learn more.

The Challenges Facing These ID Solutions

Apart from the fact that some of the solutions don’t scale in the same way as they once did — i.e. IDs created from hashed email addresses aren’t as readily available as IDs stored in third-party cookies — all these identity solutions face the same challenges; they still revolve around identification and rely on some type of ID.

This is a problem because companies with walled gardens, like Google and Apple, are constantly strengthening their products to make them more privacy-friendly.

We’ve seen this with Apple’s ITP and changes to IDFA, and even Google has made changes to how Chrome handles third-party cookies and is also planning on phasing them out soon (possibly in 2025).

AdTech companies are moving from one identification method to another, and it won’t be long until Apple and/or Google make some changes to their web browsers or mobile operating systems to prevent these identification methods.

For this reason, many folks in the industry believe that these ID solutions are rather short-term solutions.

Many say that the future of digital advertising and marketing won’t be done on an individual basis but rather done in a privacy-friendly way where individuals are not identified.

It’s too early to say if and when identification will disappear completely, so in the meantime, companies need to use an identity solution like the ones listed above to ensure they can still run effective advertising and marketing campaigns.

We Can Help You Build an AdTech Platform

Our AdTech development teams can work with you to design, build, and maintain a custom-built AdTech platform for any programmatic advertising channel.