You may have seen news reports over the past year or so about antitrust investigations into Google, Amazon, Facebook, and Apple (GAFA). There’s a lot going on in this space with governments from various countries launching their own investigations into the dominance of these tech companies.

To help you understand what’s happening, we’ve put together a list of the main investigations into GAFA.

Antitrust Investigations and Lawsuits

Meta to fight EU antitrust allegations in Facebook Marketplace case — July 12, 2023

Meta Platforms intends to counter the European Union’s accusations that the tech giant hindered competition from classified ad competitors through the integration of Facebook Marketplace with its social network.

According to sources familiar with the matter, Meta is scheduled to participate in a private hearing in Brussels, where it intends to challenge the European Union’s accusations of illegal abuse of dominance.

In December 2022, the European Commission accused Meta of hindering classified-ad services’ access to potential customers by providing automatic access to Marketplace for Facebook users. The EC also investigated Meta for imposing unfair business conditions on ad services using Instagram and Facebook.

Read more about this investigation here: Meta to fight EU antitrust allegations in Facebook Marketplace case – report

EU top court sides with Germany in Meta antitrust case — July 4, 2023

Meta challenged Germany’s anti-monopoly watchdog’s 2019 ruling, which required user consent for data collection. The decision could impact other tech giants.

In a recent ruling (July 4, 2023), the highest court of the European Union declared that antitrust authorities of member states possess the right to verify tech companies’ adherence to data protection regulations.

The case was brought before the European Court of Justice (ECJ) following a directive from the German antitrust agency, which instructed Meta, the owner of Facebook, to cease the collection of users’ data without their consent.

The regulatory agency determined that by accepting Facebook’s terms of use in order to create an account, individuals were not providing genuine consent because of the platform’s dominant position in the market.

Meta contested this decision, claiming that the German antitrust authority had exceeded its jurisdiction.

Read more about Germany’s Federal Cartel Office’s lawsuit against Meta’s data collection here: EU top court sides with Germany in Meta antitrust case

EU officials accuse Google of antitrust violations in its ad tech business — June 14,2023

European Union officials have expressed their belief that the advertising business of Google should be divided, citing concerns that the company’s participation across various aspects of the digital advertising supply chain gives rise to “intrinsic conflicts of interest.” These conflicts, they argue, have the potential to undermine competition and pose risks to the industry.

The EU Commission has submitted written allegations to Google, initiating a legal process that may result in substantial fines and potentially impact its core advertising business through a potential breakup.

The commission claims that Google has unjustly given preferential treatment to its own ad exchange, AdX, by leveraging its ownership of popular ad tools for publishers and advertisers since 2014.

Read more about this investigation here: EU officials accuse Google of antitrust violations in its ad tech business

Republican Utah Senator Mike Lee Reintroduces an Antitrust Bill Called the AMERICA Act — March 30, 2023

Republican Utah Senator Mike Lee reintroduced an antitrust bill that aims to force big tech companies, mainly Google and Facebook, to sell off parts of their advertising business.

The first attempt at reigning in big tech came via Lee’s Competition and Transparency in Digital Advertising Act, which he introduced in May 2022 along with Senators Amy Klobuchar (D-MN), Ted Cruz (R-TX), and Richard Blumenthal (D-CT).

It didn’t pass Congress, thus the reason for Lee’s second attempt via the Advertising Middlemen Endangering Rigorous Internet Competition Accountability Act, or AMERICA Act for short.

One of the key parts to the AMERICA Act is that companies that make $20 billion or more in revenue from digital advertising would not be allowed to own tech on both sides of the transaction — i.e. a demand-side platform (DSP) and a supply-side platform (SSP). With Google and Meta earning $224 billion and $113 billion in ad revenue respectively in 2022, they would both automatically fall into that category.

Read more about the AMERICA Act here: Utah Senator Mike Lee Introduces (Yet Another) Antitrust Bill Targeting Ad Tech

The US DOJ to Sue Google In an Attempt to Break Up Its AdTech Business — January 24, 2023

The US Department of Justice (DOJ) is set to file a lawsuit against Google alleging that it has violated antitrust laws by acquiring companies to increase its dominance in the digital advertising industry, by owning many components of the AdTech ecosystem, and engaging in anti-competitive behavior.

The DOJ already has a lawsuit against Google for its search and search advertising businesses.

According to the filing, the DOJ is asking for Google’s ad exchange and publisher ad server (Google Ad Manager) to be spun off.

Read more about the DOJ’s lawsuit against Google’s advertising business here: DOJ sues Google over its dominance in online advertising market

Google Faces a €25bn (£21.6bn) Lawsuit In the UK and EU — September 13, 2022

Two litigation funding law firms — one arising from the UK and the other from the Netherlands — have filed lawsuits against Google for anticompetitive behavior in the digital advertising industry.

Google is being accused of abusing its dominant position in the digital advertising industry by putting its own interests first when conducting ad auctions between publishers and advertisers.

The lawsuits are seeking compensation that could reach €25bn (£21.6bn).

Read more about the UK and EU lawsuits against Google here: Google faces €25bn lawsuit in UK and EU over digital advertising — The Guardian

Germany’s Antitrust Watchdog, the Federal Cartel Office (FCO), Investigates Apple’s ATT Privacy Framework — June 14, 2022

Germany’s Antitrust Watchdog, the Federal Cartel Office (FCO), has opened an investigation into Apple’s App-Tracking Transparency (ATT) privacy framework to determine whether it is breaching antitrust laws by self-preferencing and/or impeding competition for other companies.

One of the main concerns that the FCO has is whether Apple is applying the ATT privacy framework to itself.

Andreas Mundt, President of the Bundeskartellamt, worte in the press release: “We welcome business models which use data carefully and give users choice as to how their data are used. A corporation like Apple which is in a position to unilaterally set rules for its ecosystem, in particular for its app store, should make pro-competitive rules. We have reason to doubt that this is the case when we see that Apple’s rules apply to third parties, but not to Apple itself.”

Read more about Germany’s investigation into Apple’s ATT here: Germany’s antitrust watchdog latest to probe Apple’s app privacy framework — TechCrunch

US Senators Aim to Introduce Bill to Break Up Google’s Ad Business — May 3, 2022

A group of both Democratic and Republican senators are aiming to introduce new legislation that will force Alphabet, Google’s parent company, to sell off parts of its AdTech business.

The bill would prevent companies with more than $20 billion in advertising revenue from owning both the buy- and sell-side AdTech platforms and the ad exchanges that facilitate the transactions.

Also, companies with over $5 billion of ad revenue would need to act in their clients’ best interests and provide transparency into their data-collection processes and their fees.

Read more about this bill here: Senators Seek to Loosen Google’s Grip on Digital Ad Market — Bloomberg

The EU and Britain Open Investigations into Google and Facebook’s “Jedi Blue” Ad Deal — March 11, 2022

On Friday March 11, 2022, the EU’s antitrust authority and Britain’s Competition and Markets Authority (CMA) opened parallel investigations into Google and Facebook’s secret ad deal called Jedi Blue.

The Jedi Blue scandal was first brought to light when 10 US states, led by Texas Attorney General Ken Paxton, launched a lawsuit against Google and its secret ad deal with Facebook.

Read more about this investigation here: Google and Facebook ‘Jedi Blue’ ad deal probed by EU, Britain — Reuters

Google Sued by Two Massachusetts Companies Over the Jedi Blue Ad Deal — August 3, 2021

On August 3, 2021, two Massachusetts companies — SkinnySchool trading as Maria Marques Fitness and Mint Rose Day Spa — filed a class action lawsuit against Google over its anticompetitive Jedi Blue ad deal with Facebook.

The lawsuit claims that Google was able to continue and strengthen its dominance of the online advertising industry when it made an ad deal with Facebook. The deal, which was named Jedi Blue by Google and Facebook, involved Google giving Facebook preferential rates and first dibs on prime ad placement.

In exchange, Facebook would use Google’s version of header bidding, Open Bidding, and agreed not to build its own header bidding solution nor use the open-source version, Prebid.

Read more about this lawsuit here: Class Action Lawsuit Filed Against Google Related to Fixing Ad Rates With Facebook Deal — Justia Legal News

The EU Investigates Google’s AdTech Business — June 22, 2021

The European Union has opened a formal antitrust investigation into Google’s advertising business. The EU will investigate possible anticompetitive behavior from Google, including:

- Google’s decision to shut off access to third-party DSPs to its YouTube inventory and make it solely available via its DV360 platform.

- Whether Google has favored its own AdTech platforms during digital advertising transactions.

- Google’s plans to block third-party cookies in Chrome and changes to its AAID in Android devices.

This EU investigation covers similar areas to other antitrust investigations into Google’s AdTech business, such as the one conducted by Republican attorneys from 10 states where they sued Google for anticompetitive behavior and the antitrust investigation from the US DOJ.

The main difference between those cases and this from the EU is that the EU will look into Google’s decision to shut off access to third-party DSPs to its YouTube inventory and its plans to shut off third-party cookies and its proposed changes to its AAID.

The UK’s Competition and Markets Authority (CMA) Opens Investigation Into Google and Apple’s Mobile Ecosystem — June 15, 2021

The UK’s Competition and Markets Authority (CMA) has launched a market study of Google and Apple’s mobile ecosystems that will look at whether tech giants’ practices in the mobile world harm consumers and other businesses.

In particular, the CMA is worried that Google and Apple’s duopoly over the supply of mobile operating systems, app stores, and web browsers could have negative consequences for those who use and conduct business on them. Possible negative consequences include lower quality apps and services, issues within the mobile advertising market, higher prices for apps and in-app purchases, and less innovation in the mobile ecosystem.

Read more about this investigation here: UK’s Competition Watchdog Launches Sprawling Investigation into Apple and Google’s Mobile Ecosystems – VideoWeek

US House Lawmakers Could Introduce Bill That Will Split up Google, Apple, Facebook, and Amazon’s Businesses — June 11, 2021

US House lawmakers have proposed a range of bipartisan legislation aimed at reigning in the country’s biggest tech companies, including Google, Apple, Facebook, and Amazon.

One of the proposed measures, titled the Ending Platform Monopolies Act, aims to make it unlawful for online companies like Amazon to both operate a platform and sell products and services on it, like what Amazon does with it’s ecommerce platform and private-labelled products.

Another bill would aim to prevent companies from making changes or using their platforms in a way that would give it an advantage over other businesses and users of the platform.

The proposed legislation would need to be passed by the Democratic-controlled House as well as the Senate, where it would likely also need substantial Republican support.

Read more about this story here: House Bills Seek to Break Up Amazon and Other Big Tech Companies – WSJ

Google Won’t Pull the Plug on Third-Party Cookies in the Unless It Gets Permission From the UK’s Competition Regulator First — June 11, 2021

Google has committed to working with the UK’s CMA and ICO as it works to shut off third-party cookies and builds its Privacy Sandbox.

This announcement by Google is part of the CMA and ICO’s investigation into Google’s Privacy Sandbox (see below).

Google has said that it won’t favor its own AdTech business over its competitors when developing its Privacy Sandbox and will provide more transparency into its proposals and any tests it performs on their performance.

The CMA and ICO will consider whether to accept Google’s proposals and companies will have until July 8, 2021, to submit their comments.

Read more about this story here: Google Pledges Not To Kill Third-Party Cookies Without The UK Competition Watchdog’s Say-So – AdExchanger

Google Pays a $268 Million Fine and Promises to Change Its Advertising Business Following an Investigation From France’s Competition Authority — June 7, 2021

France’s competition authority, Autorité de la Concurrence (ADLC), has reached a deal with Google which will see the tech giant pay a $268 million fine and make changes to its advertising business.

Here’s an overview of Google’s changes:

- Google will ensure that all buyers, even those not using Google’s DSP, will get equal access to data related to the outcome of Ad Manager auctions.

- Google will improve interoperability between Google Ad Manager and third-party ad servers and allow publishers to set their own pricing rules and custom floors for ads that fall into sensitive categories, such as gambling and politics.

- Google will also not place limits on a publisher’s ability to negotiate specific terms or pricing with other SSPs and will not use data from other SSPs to optimize bids in its exchange in a way that other supply-side platforms can’t reproduce. This practice, known inside Google as Project Bernanke, was uncovered by the WSJ when it obtained a mistakenly unredacted court filing.

Read more about this story here: Google Commits To A More Level Ad Tech Playing Field In Big Antitrust Settlement With France – AdExchanger

The European Commission and UK’s CMA investigate Facebook over unfair competition with advertisers — June 5, 2021

The European Commission and UK’s CMA have both launched antitrust investigations into Facebook to determine whether it was using customer data to unfairly compete with advertisers.

The European Commission’s investigation will focus on whether Facebook has violated EU competition law to unfairly compete with advertisers in its Marketplace classified business.

The UK investigation, led by the Competition and Markets Authority (CMA), will look at how Facebook collects and uses data from advertisers. Specifically, the CMA will aim to determine how Facebook’s single sign-on feature, which gives access to other websites with a Facebook login, can benefit the social media network’s Marketplace and the Facebook Dating business.

Read more about this story here: Facebook’s Marketplace in EU and UK antitrust crosshairs – Reuters

The UK’s Competition and Markets Authority Investigates Google Chrome’s Privacy Sandbox — January 8, 2021

On January 8, 2021, the UK’s competition watchdog opened an investigation into Google’s intent to eliminate third-party cookies and other functions from Chrome browser that would negatively affect the advertising and marketing industry.

The Competition and Markets Authority (CMA) announced that it received a complaint from Markets of an Open Web (MOW), a coalition of technology and publishing companies.

According to a recent CMA study, Google’s Privacy Sandbox proposal will severely alter the digital advertising market and have a big impact on publishers.

Google responded by saying that it requires the industry to make some modifications to the way digital advertising operates to create a more private web, while continuing to provide a sustainable advertising model for the publishers and advertisers who support the free and open web.

Read more about this investigation here: UK’s competition watchdog to probe Google’s browser changes – Reuters

Ten US States Sue Google Over Its Secret “Jedi Blue” Ad Deal with Facebook — December 16, 2020

On Wednesday December 16, 2020, ten US states sued Google over a secret ad deal it set up with Facebook called Jedi Blue.

The ad deal, which was approved by Google’s CEO Sundar Pichai and Facebook’s CEO Mark Zuckerberg in 2018, involved Facebook agreeing that it wouldn’t use header bidding (even though it did in 2017) or build its own header bidding solution but would use Google’s version of header bidding — Open Bidding.

In exchange, Google would give Facebook preferential rates and first dibs on prime ad placement.

Read more about the lawsuit here: Ten States Sue Google, Alleging Deal With Facebook to Rig Online Ad Market — WSJ

Online Publishers Sue Google in Advertising Antitrust Lawsuit — October 20, 2020

On Wednesday October 20, 2020, Genius Media Group together with The Nation put forward a lawsuit seeking justice over Google, claiming that it has hurt their businesses by controlling advertising opponents and displaying anticompetitive conduct.

The lawsuit is supported by another antitrust complaint which was issued earlier in the U.S District in San Jose, California by Texas and nine other U.S states against Google.

Genius is an online song lyrics and musical knowledge platform while the Nation is one of the oldest U.S weekly magazines covering progressive political and culture news, opinion and analysis.

Genius, the Nation, and the Progressive said they used Google to show advertisements on their websites, but claimed to receive an unfair share of the ad revenue because of dominance of the online advertising market.

Google has repeatedly said that companies use Google services because of their own choice, and that there are many other advertising services that companies can use.

Read more about the lawsuit here: Genius Media, The Nation sue Google in advertising antitrust lawsuit – Reuters

The US Department of Justice (DOJ) Investigates Google — 20 October, 2020

On Tuesday October 20, 2020, the US Department of Justice (DOJ) opened an investigation into Google’s dominance of its search and search advertising businesses.

According to the DOJ, Google has an 88% share of the US search market and a 70% share of the search ads market.

The DOJ’s investigation into Google’s anticompetitive activities started in 2019 and looked at the following areas:

- Google’s agreements with companies like Apple to make Google Search the default search engine on Apple devices.

- Google’s agreements with Android device manufacturers to include certain Google apps and prevent users from removing them.

The DOJ states that these exclusionary agreements hampers competition, suppresses innovation in the search market, and allows Google to charge more for lower-quality services.

Google responded by saying that the DOJ investigation is highly flawed, stating that consumers choose to use Google’s services because they wanted to, not because there is a lack of alternatives.

So far, eleven Republican state attorneys general have so far joined the lawsuit, with the possibility of more attorneys generals from other states joining the lawsuit in the future.

Read more about the DOJ investigation here: Google sued by DOJ in antitrust case over search dominance – CNBC

A Bipartisan Group of State Attorneys General Sue Google — December 17, 2020

In December 2020, a bipartisan group of state attorneys general from 38 states sued Google for anticompetitive conduct relating to its search and search advertising businesses.

The lawsuit is very similar to the DOJ’s lawsuit (listed above) but provides more examples of Google’s anticompetitive behavior to secure the dominance of its services (e.g. search engine and mobile apps).

The lawsuit outlines that Google has maintained its dominance over its competitors by:

- Signing contracts with companies, such as Apple, Android device manufacturers, and carriers like AT&T, T-Mobile, and Verizon, to ensure its services and apps are preloaded onto devices and set as defaults. The agreements also often prevent companies from pre-installing or adding competitor services like Microsoft’s Bing search Engine.

- Disallowing advertisers to use non-Google owned ad platforms to show ads on Google’s search engine.

- Limiting the presence of vertical search engines like TripAdvisor and Yelp on Google’s search engine.

Read more about this lawsuit here: Google hit with its third antitrust lawsuit since October, this time by a bipartisan coalition of states – CNBC

Republican Attorneys from 10 States Sue Google Over Anticompetitive Behavior in the Digital Advertising Market — December 16, 2020

On Wednesday December 16, 2020, Republican attorneys from 10 states sued Google for its dominance of the digital advertising market.

The main allegations are that Google overcharged advertisers, boxed out competitors and squeezed publishers, adding up a monopoly tax on businesses.

The lawsuit also accused Google of cutting an illegal deal with Facebook to manipulate the auctions through which most digital ads are sold.

Facebook gained an advantage in some Google-run auctions, according to the complaint, and in return it did not challenge Google’s dominance.

As a result, most medium and small companies were exposed to higher prices for ads and consumers were receiving lower quality goods, services and information in Google Search.

Read more about this lawsuit here: Google Hit With 2nd Lawsuit Testing Its Monopoly Power — This One Over Digital Ads – NPR

The FTC and Attorneys General Sue Facebook Over Illegal Monopolization of the Social Networking Market — December 9, 2020

On Wednesday December 9, 2020, the US Federal Trade Commission (FTC) and 48 attorneys general sued Facebook for alleged illegal monopolization of the social networking market.

Although both of these lawsuits are separate, they were both announced at the same time and concern the same topic; Facebook’s violation of antitrust laws.

The lawsuits focus on Facebook’s acquisitions of Instagram and WhatsApps, stating that Facebook acquired these companies as it viewed them as significant competitors that would threaten Facebook’s dominance.

Some of the main issues listed in lawsuits include:

- No real alternatives for advertisers in the social media market.

- A lack of transparency around Facebook’s reporting metrics due to the inability to audit Facebook’s numbers.

- The removal of privacy protections in an effort to increase monetization of its data through advertising.

- The acquisition of key competitors; Instagram and WhatsApp.

- The enforcement of anti-competitive conditions on third-party software developers using its APIs.

Read more about this lawsuit here: FTC And 48 AGs File Two Separate Antitrust Lawsuits Against Facebook – AdExchanger

The Australian Government Introduces a New Media Bargaining Code to Make Google and Facebook Pay for Distributing News — December 2017

While most governments are opening antitrust investigations into Google and Facebook, the Australian government has decided to tackle the duolpolgy’s dominance in a different way.

In December 2017, the Australian Government asked the Australian Competition and Consumer Commission (ACCC) to open an inquiry into Google and Facebook to determine the impact those companies have on competition in the media and advertising markets in Australia.

The ACCC released a preliminary report in December 2018, expressing concerns about the dominance of Google and Facebook. The report revealed the following:

- Google and Facebook are seen as dominant gateways between news media businesses and audiences, with many traditional media businesses losing ad revenue because of these platforms.

- These two platforms could potentially create filter bubbles or echo chambers whereby consumers are only shown certain types of news stories or less reliable news. The ACCC stated that there isn’t enough evidence yet of this situation in Australia, but requires close scrutiny.

- Google and Facebook collect large amounts of user data, most of which isn’t provided knowingly by consumers.

- Google and Facebook are more than just distributors of news; they perform functions that are akin to media businesses, such as selecting, curating, and ranking content.

The report also touched on antitrust, stating that “Australian law does not prohibit a business from possessing significant market power or using its efficiencies or skills to ‘out compete’ its rivals. But when their dominant position is at risk of creating competitive or consumer harm, governments should stay ahead of the game and act to protect consumers and businesses through regulation.”

It also touched on Google’s dominance of the web browser and search engine markets, with the report including a proposal that would prevent Google Chrome and Google Search being installed as the default options on mobile devices, computers, and tablets.

Then in July 2019, the ACCC released the final report and executive summary. For the most part, the code would require Google and Facebook to negotiate deals with media companies whereby the tech giants would pay them for the content they distribute.

This set off a flurry of backlash from Google and Facebook.

Google responded to the report by publishing a letter and video to Australians, stating that the proposed new code would break how its search engine works, lead to a bad user experience on Google Search and YouTube, and break the open and free Internet.

Google threatened to block Australians from using Google Search, but later changed its mind and agreed to set up deals with news publishers to pay them for links displayed on its search engine.

Facebook initially kept rather quiet on the matter, but did state that removing links to news sites wouldn’t have a big impact on its business and that it sent 2.3 billion clicks to Australian news sites between January and May 2020. Facebook claimed the value of those clicks was worth an estimated $200 million to Australian news companies and that it wouldn’t pay for sharing links to news websites.

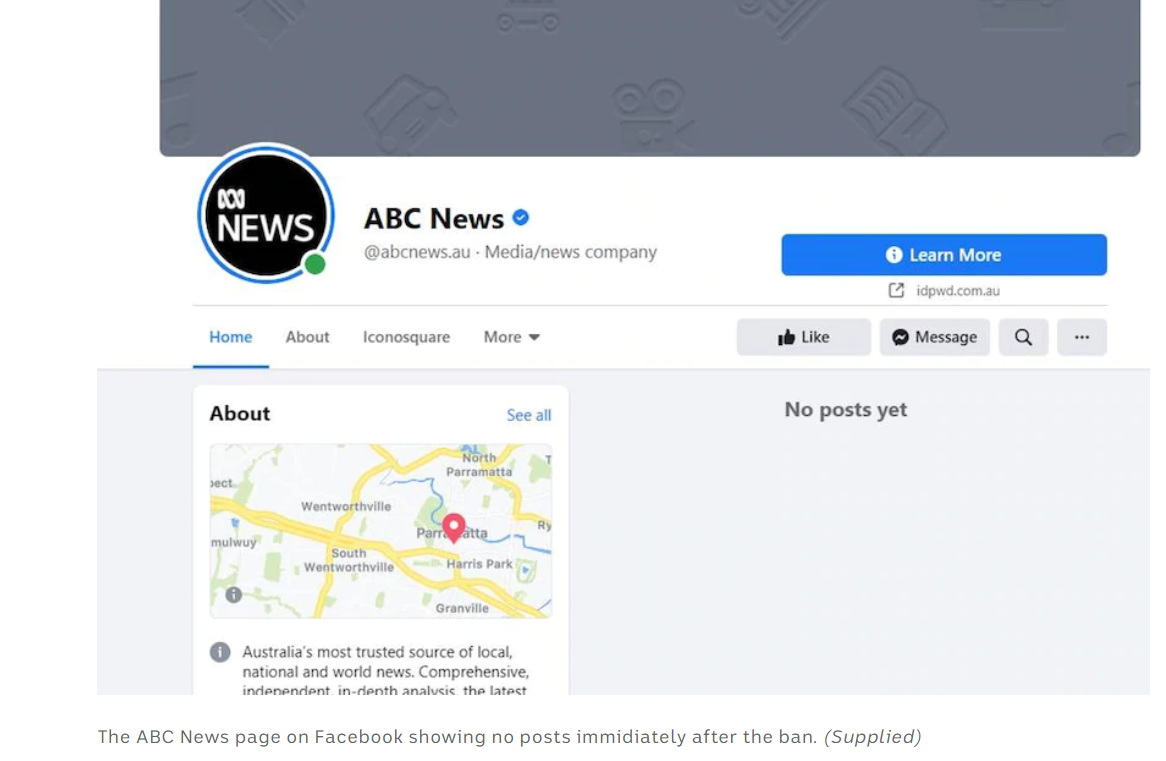

Then in February 2021, Facebook made the bold decision to block Australian news websites from its platform.

Many news publishers, and even some non-news businesses, found that their Facebook posts had been removed.

Image source.

Facebook faced immediate backlash from the Australian government and news companies.

Then, only 6 days later, Facebook lifted the ban and reinstated the posts, following the Australian government’s decision to make changes to its media bargaining code. Facebook said that it will work on signing commercial deals with news publishers.

There are a couple of interesting observations to take out of all of this:

- Although Google Search is the dominant player in the search-engine market, it really does not want to give up even a slitter of its market share. When Google initially toyed with the idea of blocking Australians from using its search engine, the consensus was that Australians would just start using other search engines like Microsoft’s Bing and DuckDuckGo. This may have motivated Google to enter into discussions and set up commercial deals with news publishers.

- Facebook is in a slightly different position than Google in the sense that there is no 1-to-1 alternative to Facebook. Sure, there are other social media platforms like Twitter where news content is distributed, but it’s not the same as the competition between Google and Bing. By removing posts from news companies, Facebook may have been testing the waters and used it as a negotiation tactic to get the Australian government to make changes to its code.

Read more about this story here:

- Google and Facebook to be forced to share revenue with media in Australia under draft code – The Guardian

- Facebook blocks Australian users from viewing or sharing news – The BBC

- Facebook to reverse news ban on Australian sites, government to make amendments to media bargaining code – ABC Australia

Government Hearings

In between these investigations and lawsuits, there have been a number of hearings between government committees and members from GAFA.

Below is a list of the hearings:

- The House Judiciary subcommittee on Antitrust, Commercial, and Administrative Law — July 29, 2020

- Stacking the Tech: Has Google harmed competition in online advertising? — September 15, 2020

Other Lawsuits Against GAFA That Are Not Connected to Advertising

The UK’s Antitrust Regulator Opens Antitrust Investigation Into Apple’s App Store Rules – 4 March, 2021

On the 4th of March, 2021, the UK’s Competition and Markets Authority said it opened an investigation into Apple’s App Store rules.

The aim of the investigation is to determine whether Apple’s App Store rules create unfair or anti-competitive conditions for app developers.

Specifically, the investigation will look at how much control Apple should have over app developers and the commission Apple takes from its in-app purchase system.

This case is very similar to the one the EU opened in June 2020 (see below).

The US State of Connecticut Opens an Antitrust Investigation Into Amazon’s Ebook Business – 13 January, 2021

On the 13th of January, 2021, the US state of Connecticut opened an antitrust investigation into Amazon’s ebook business. Connecticut’s attorney general, William Tong, said that the state is investigating Amazon’s anti-competitive terms in its distribution agreements it has with some ebook publishers.

Representatives in California and Washington along with The Federal Trade Commission have been examining the way Amazon treats independent merchants and the retailer’s online dominance over smaller competitors.

Read more about this investigation here: Connecticut is investigating Amazon’s practices in the e-books market – The New York Times

Epic Games Kick Starts Antitrust Bills Across US States — August 2020

In August 2020, Epic Games, the makers of Fortnite, got into a row with Apple over the commissions it takes on in-app purchases and the fact that app developers can’t use alternate payment systems.

It all started when Epic Games implemented its own payment system in its Fornite app in iOS. In response, Apple blocked Fortnite from its App Store. Google followed suit when Epic Games did the same thing with its Fornite app in Android.

This row led to Epic Games launching a lawsuit against Apple and Google, which caught the attention of governments, legislators and state senators. Subsequently, many US states including Arizona, Georgia, Hawaii, Illinois, New York, Massachusetts and Minnesota proposed bills that would require Apple and Google to allow app developers to offer alternate payment systems. A bill was also proposed in North Dakota but was rejected in February 2021.

In March 2021, the Arizona bill passed the state house and moved to the senate.

The European Commission Opens an Antitrust Investigation into Apple’s App Store Rules – 16 June, 2020

In June 2020, the European Commission opened an antitrust investigation into Apple’s App Store rules on the back of a complaint made by Spotify and an ebook and audiobook distributor.

The investigation will look into whether Apple’s App Store rules violate EU Antitrust Regulation. The crux of the investigation relates to two restrictions that Apple imposes in its agreements with companies that distribute apps on Apple devices.

The first restriction being Apple’s 30% commission on all subscription fees through In-App Purchases (IAP) scheme. The second restriction relates to the ability for app developers to inform users about alternative, and generally cheaper, purchasing options outside of apps.

Read more about this investigation here: Antitrust: Commission opens investigations into Apple’s App Store rules – European Commission

The European Commission Investigates Amazon Over Anti-Competitive Practices Against Independent Sellers – 17 July, 2019

In July 2019, the European Commission filed an antitrust investigation to determine whether Amazon has breached European competition rules by using sensitive data from independent retailers who sell products on its marketplace.

The lawsuit will assess:

- The agreements between Amazon and marketplace sellers and whether the fact that Amazon is allowed to analyze and use third party seller data for its retail businesses affects competition.

- The role of data in the selection of the winners of the “Buy Box” and its impact on potential use of sensitive seller information.

The commission will look into the Amazon practices that may breach European competition rules between companies and the abuse of a superior position.

Read more about this investigation here: Antitrust: Commission opens investigation into possible anti-competitive conduct of Amazon – European Commission

Then, on the 10th of November, 2020, the European Commission sent Amazon a Statement of Objections relating to the first antitrust investigation by the EC (the one from July 17, 2019).

The Commission also launched a second antitrust investigation to determine Amazon’s alleged preferential treatment to its own retail offers versus its treatment towards non-Amazon marketplace sellers that use logistics and delivery services provided by Amazon.

The objections in the case include:

- Amazon’s dual role as a platform where:

- Amazon provides a marketplace where individual sellers can sell products directly to consumers.

- Amazon sells products as a merchant on the same marketplace, competing with the individual sellers.

- Amazon as a marketplace provider:

- It has access to non-public business information of third-party sellers, such as the number of ordered and shipped products, revenue, the amount of visits to advertised products, shipping data, and past performance.

The investigation is still in progress but the initial findings show that vast amounts of non-public seller data is available to Amazon. This allows Amazon to adjust its retail offers and create strategic business decisions that may disadvantage other sellers in the marketplace.

Read more about this investigation here: Antitrust: Commission sends Statement of Objections to Amazon for the use of non-public independent seller data and opens second investigation into its e-commerce business practices – European Commission

The UK’s Competition and Markets Authority (CMA) Opens Investigation Into Google and Apple’s Mobile Ecosystem — June 15, 2021

The UK’s Competition and Markets Authority (CMA) has launched a market study of Google and Apple’s mobile ecosystems that will look at whether tech giants’ practices in the mobile world harm consumers and other businesses.

In particular, the CMA is worried that Google and Apple’s duopoly over the supply of mobile operating systems, app stores, and web browsers could have negative consequences for those who use and conduct business on them. Possible negative consequences include lower quality apps and services, issues within the mobile advertising market, higher prices for apps and in-app purchases, and less innovation in the mobile ecosystem.

Read more about this investigation here: UK’s Competition Watchdog Launches Sprawling Investigation into Apple and Google’s Mobile Ecosystems – VideoWeek