Back in 2012, the Singapore-based telecommunications company SingTel acquired Amobee, an AdTech company offering a demand-side platform (DSP), for $321 million.

In the years following, many other telcos entered the AdTech industry by either building their own tech or spending millions, and even billions, of dollars on acquiring existing AdTech businesses.

Some of these ventures have worked out and some haven’t.

In this article we take a closer look at the telcos that have entered AdTech, how they’ve fared, and the options telcos have when wanting to enter AdTech.

A Bumpy Road for Buyers

Verizon, AT&T, Telenor, and Singtel all acquired mature AdTech companies, but each of these ventures ended up with the telcos selling off their AdTech assets.

The inability to generate notable financial results, improper usage of the AdTech and data assets, and the wrong business strategy are some of the main reasons for these acquisitions not working for telcos.

Here’s an overview of why some telcos couldn’t make their AdTech acquisitions work:

- AT&T’s sale of Xandr shows us that growing a new arm of an existing business is challenging and acquiring an AdTech platform doesn’t always deliver a positive ROI. Also, Xandr’s goal was to compete with Google and Facebook, which proved harder to achieve than first thought.

- Telenor’s sale of Tapad reveals that telcos struggle with technical problems, such as integrating the tech with existing operations and proper use of the assets.

- Verizon’s sale of Yahoo! and AOL also pointed out the challenges in competing with Google and Facebook.

The lack of specialization in AdTech doesn’t help either.

Integrating an existing and mature piece of software into a company’s existing systems is an enormous challenge in itself, which is multiplied when that piece of software is an AdTech platform.

For most telcos, the goal behind entering AdTech is to monetize their customer data and open up their inventory to brands and ad agencies. Simply acquiring an AdTech platform won’t achieve that — there are many integrations that you’ll need to set up to connect all the systems together. A lack of AdTech knowledge and know-how will make this process even more difficult.

And finally, all of these cases show that acquiring an existing AdTech doesn’t always produce the results they expected, leading to the false conclusion that digital advertising can’t represent a new arm of a telecommunications business.

“While acquiring an existing AdTech business may seem like the obvious choice for telcos, as we’ve seen, it often ends up becoming a very expensive failure. There are other ways telcos can enter AdTech and build successful businesses, such as developing the software. This not only allows telcos to build software that meets their business goals and properly integrates with their existing systems, but also enables them to receive a working platform without a huge price tag attached to it”, says Piotr Banaszczyk, CEO at Clearcode.

The Telcos That Entered AdTech and Succeeded

While many telcos have failed to make their AdTech businesses work, there are companies that have succeeded, such as Alticel, Ericsson and T-Mobile.

In 2019 T-Mobile bought PushSpring, an AdTech company specializing in mobile ads and push notifications.

In January 2022 the telco also acquired Octopus Interactive, a rideshare-focused advertising startup. The company announced that it is committed to AdTech and plans to become a multibillion dollar player in the industry.

The key to their strategy was to acquire relatively small AdTech companies operating in niche markets instead of acquiring a huge AdTech player.

If T-Mobile has made their AdTech acquisitions work, then maybe the key to succeeding in AdTech is to start small and grow incrementally.

But acquiring AdTech companies isn’t the only way to achieve this — telcos also have the option of building the tech, which in many cases may prove more advantageous.

Advantages of Building AdTech Platforms for Telcos

When building their own AdTech platform, telcos have the most to gain as it allows them to develop software that can be customized to their technical requirements and well-aligned with their business goals.

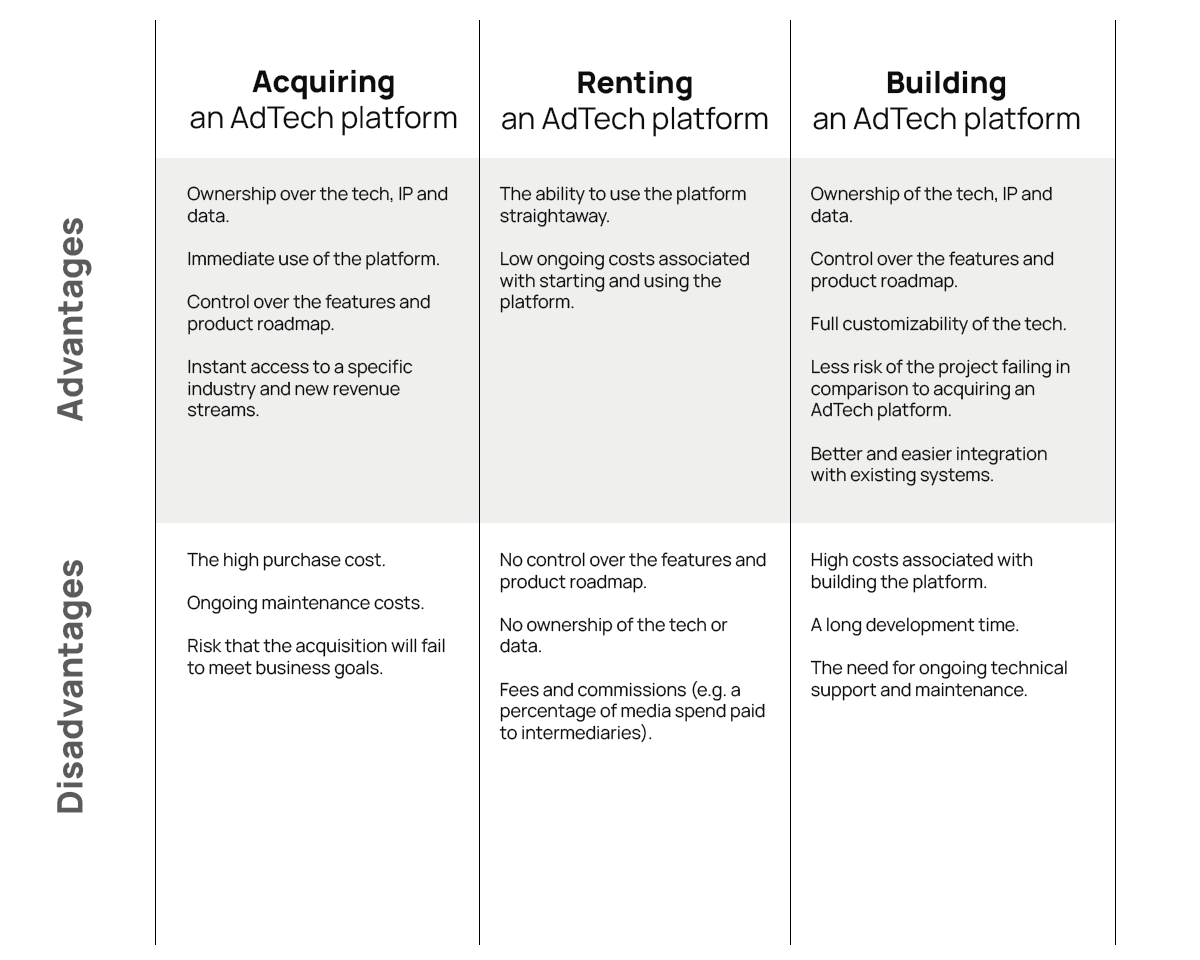

The main advantages of building an AdTech platform for telcos are:

- Ownership of the tech, IP and data.

- Control over the product roadmap.

- Full customizability of the tech.

- Less risk of the project failing in comparison to acquiring an AdTech platform.

- Better and easier integration with existing systems.

The main disadvantage of building an AdTech platform is that it will take anywhere from 6 to 12 months to build the minimum viable product (MVP).

Also, it will cost much more to build an AdTech platform than to rent one, but will be less expensive than acquiring an existing AdTech company.

Below is a simple comparison of the pros and cons of acquiring, renting and building an AdTech platform.

How Telcos Can Ensure Success in AdTech via Custom Development

As the stories above have highlighted, acquiring an existing and huge AdTech company hasn’t translated into success for many telcos.

T-Mobile seems to have proven that AdTech acquisitions can work with its purchase of AdTech startups in niche markets.

However, even acquiring a small AdTech company can present challenges around technical incompatibility and system integration issues.

Telecommunications companies that want to succeed should take a closer look at the option of building a custom AdTech solution.

But even software development projects can be seen as a risky venture.

So how can telcos ensure they succeed in not only building a viable AdTech business but also building a working AdTech platform?

One of the keys to building and launching a working AdTech platform is to build it with software engineers familiar with the programmatic advertising landscape and experience in developing AdTech platforms.

For most telcos, understanding the AdTech ecosystem from a business perspective is a challenge, but understanding the AdTech ecosystem from a technical perspective is even more challenging.

If a software engineer doesn’t know what a demand-side platform (DSP) is, then how are they expected to build one that works?

Ultimately, the success of an AdTech development project depends on the engineers’ knowledge of the AdTech ecosystem and how the various platforms work and integrate with each other.

The Pros and Cons of Acquiring and Renting AdTech Platforms For Telcos

The Pros of Acquiring AdTech Platforms for Telcos

By acquiring an AdTech platform, telcos get instant access to a ready-to-use product and a new revenue stream.

In addition, they can extend the capabilities of the platform by building new features, setting up new integrations, and connecting it to other parts of their business.

The ownership of the solution gives them full control over the product’s roadmap and allows them to make some customizations. Telcos also have a product that is integrated with other AdTech and MarTech platforms, giving them access to various demand (advertisers) and supply (publishers) sources.

The main benefits of acquiring an AdTech platform are:

- Instant access and ownership of a working platform.

- Access to a large existing customer base.

- Working integrations with other AdTech and MarTech platforms.

The Cons of Acquiring AdTech Platforms for Telcos

One disadvantage of acquiring an AdTech platform is that the telco is limited with the technologies that power the AdTech platform. The telco could really only use the tech stack, e.g. programming languages, cloud computing service etc., that the AdTech platform was built with. This can not only create issues around maintaining and expand the platform but also limit the integration possibilities with the telco’s internal systems.

Also, the telco needs to invest a lot of money in the acquisition and there is no guarantee that the investment will result in a positive ROI.

One of the biggest challenges with acquiring an existing AdTech platform is integrating the telco’s system with the platform’s as they are two separate worlds.

The main disadvantages of acquiring an AdTech platform are:

- It requires a large amount of money upfront.

- Seeing a positive ROI can take many years, if at all.

- It can be hard to integrate it with your internal systems and tools.

- You’ll likely need to retain the software engineers who are familiar with the software.

The Pros of Renting AdTech Platforms for Telcos

Renting an AdTech platform gives telcos instant access to a working product out of the box without having to spend millions or billions of dollars on acquiring the tech.

Ongoing software maintenance and product development is handled by the AdTech vendor, allowing the telco to focus on utilizing the platform to achieve their business goals.

The main advantages of renting an AdTech platform are:

- The ability to use the platform straightaway.

- No responsibility for the product roadmap.

- You can transfer to another vendor whenever you want.

The Cons of Renting AdTech Platforms for Telcos

Out of all the options available to telcos — acquiring, renting or building — renting an AdTech platform offers the least amount of business advantages and is likely to be the least profitable option as well.

When renting an AdTech platform, telcos don’t own the platform, which means they are dependent on the AdTech company they signed the agreement with for maintaining the platform and can rarely influence the product roadmap.

The telco also is paying fees and commissions to a third-party, which can add up to millions of dollars depending on the amount of money they spend on advertising campaigns.

From a legal point of view, it’s much harder to comply with the various privacy laws and internal data security policies if a telco rents an AdTech platform, compared to acquiring or building its own.

Telcos that rent AdTech platforms won’t be able to use their own first-party data for ad targeting and measurement, which is growing in popularity because of the changing privacy landscape, because of their strict internal and external legal policies around using and sharing customer data.

The main disadvantages of renting an AdTech platform are:

- Depending on the amount of media spend, renting a third-party AdTech platform might mean paying millions of dollars in fees and commissions a year to the vendor.

- You may not be able to get the most out of the AdTech platform because of restrictions around privacy and security policies, e.g. the use of customer data for ad targeting.

- You are totally dependent on the vendor in terms of new features and system uptime.

Summary

Despite some of the recent exits, telcos still have an opportunity to build an additional source of revenue in the AdTech industry.

They have the capacity, capital and resources to enter AdTech, but may have taken the wrong path.

Acquiring large AdTech companies hasn’t resulted in the success that many telcos had planned and using an existing AdTech platform doesn’t provide any business advantages and comes with a number of privacy and data security restrictions.

To ensure success in AdTech, telcos have a lot to gain by building their own tech, such as ownership of the software, IP and data, as well as full control over the product roadmap and easier integration with existing systems.