There was a time, believe or not, when commercial advertising was banned on the Internet. It can be hard to imagine an online world without spam, pop-up ads, or banner ads, but whether you absolutely detest digital ads or appreciate that they help keep a lot of content free and readily available, there is no denying the rapid increase in the online advertising industry.

The Internet has proven to be a powerful, highly effective, and extremely fruitful advertising medium. Over the past few years, the industry has achieved a number of milestones –

2011 – Online advertising revenues overtook those of cable television – $36.6 vs $32.5 billion. (U.S)

2013 – Revenues from online advertising rose by 17% to $42.8 billion compared to $36.57 billion in 2012. (U.S)

2013 – For the first time, online advertising revenues exceed those from broadcasting and cable television – individually, not combined. (U.S)

2014 – Q3 revenues of the online advertising industry reached a historical high of $12.4 billion. (U.S)

2014 – Mobile advertising revenue in the first half of 2014 rose to $5.3 billion, a growth of 76% compared to the same period in 2013. (U.S)

Online advertising has morphed into a global multibillion-dollar industry that spans from traditional methods, such as email marketing, to search engine marketing (SEM), display advertising, and more recently, social media and mobile advertising.

Out of the many areas that make up the online advertising scene, one that has greatly evolved over time, and isn’t showing signs of stopping any time soon, is display advertising.

Online Display Advertising

What was once an industry solely focused on email, the increase in availability of the Internet in the 1990s created a new opportunity for online advertisers and paved the way for an even more effective way to reach their target audience – online display advertising.

1994 saw the first recorded piece of online display advertising in the form of a banner ad. It appeared on a website called HotWired and was bought by telecommunications giant AT&T, used to promote their campaign, You Will.

Over its three-month life span, the banner ad boasted a click-through rate of a massive 44% – that’s about 42% higher than today’s definition of a successful click-through rate of just 2%.

This was the beginning of what is now a highly lucrative trade.

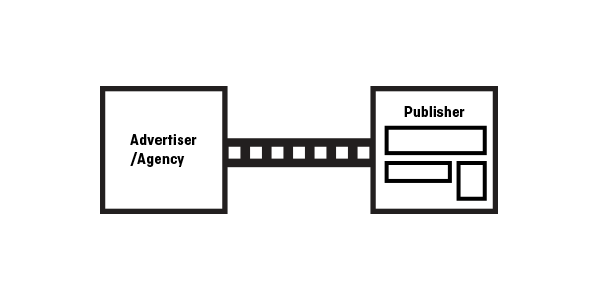

In the early days of online display advertising, the exchange between the advertisers (or agency) and the publisher (the website owner) was a direct sales process. The advertisers would contact the publisher and purchase ad space (inventory) on their website on a cost-per-thousand basis – known as Cost Per Mille, or CPM, as mille means “thousand” in Latin. This system meant advertisers would pay a certain price for every 1,000 impressions (meaning 1,000 views).

Difficulties emerged when the number of websites, and therefore publishers, began to increase. The once-straightforward direct sales process started to become more complex, unhinged, and drawn-out. While Premium ads – those bought by advertisers directly from the publishers – were still common, publishers soon found that a lot of other available inventory wasn’t being filled and fell victim to oversupply.

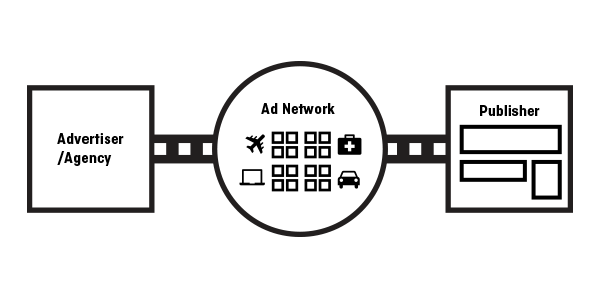

To counter this problem, advertising networks started to emerge. Ad networks act as brokers. They buy unsold (aka remnant) inventory from publishers, run the inventory through their technology, aggregate the audiences, and then package it all up and sell it to advertisers.

Both advertisers and publishers enjoy the benefits of ad networks. They provide publishers with a highly effective way to sell their 10% – 60% remnant inventory, help them cut down on the time and money associated with selling inventory to advertisers, and also offer a range of services, such as lead optimization and customer support. Advertisers benefit by receiving high cost savings and an easier, more effective way to connect with audiences on a much larger scale.

Even though the introduction of ad networks added fluency to the ad buying and selling processes, publishers soon discovered that they weren’t able to sell all their remnant inventory through one ad network, so they started selling their inventory through multiple ad networks.

The increase in the number of ad-network companies also meant that publishers spent a lot more time searching for the best-valued network. This now meant they found it hard to identify the best-performing advertisers and often had to pay out commissions to a number of different networks.

For advertisers, this also created challenges. They soon found that they weren’t able to reach their target audience by using just one ad network, so they started buying inventory from multiple ad networks and advertising exchanges.

However, buying inventory from multiple parties (e.g. ad networks and ad exchanges) meant they often bought the same audience more than once, lacked clear insights into the effectiveness of their ads, and struggled to identify their best-performing inventory.

The next revolutionary ad-buying method to hit the online display industry was the introduction of Ad Exchanges and Real-Time Bidding.

Ad Exchanges and Real-time Bidding

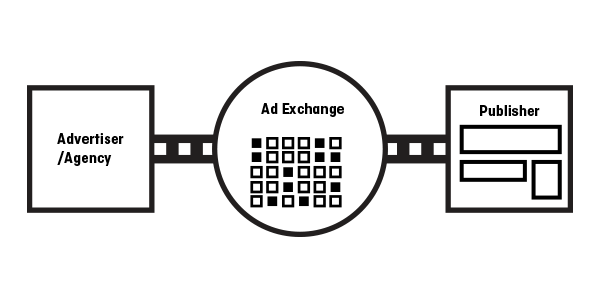

The easiest way to explain how ad exchanges operate is to compare them to the stock exchange. In the same way stock exchanges handle the buying and selling of stocks, bonds, and other securities, ad exchanges facilitate, manage, and complete the buying and selling of impressions between publishers and advertisers.

The liquidity of inventory, just like the liquidity of stocks, now means that thousands of advertisers (or media buyers) and publishers can come together on the ad exchanges and trade inventory in real time.

The introduction of ad exchanges has completely changed the way display ads are bought and sold. Instead of buying impressions on a cost-per-thousand basis shown to a wide audience that often include only a small percentage of their target audience, advertisers can now buy ads on an impression-by-impression basis. By only bidding on the impressions that are relevant to them, based on the audiences they want to reach, advertisers are able to target their true audience more directly. This also provides publishers with higher ad revenues, as their inventory is being displayed to the right users advertisers want to target.

Real-time bidding is the process that makes all this happen. The operational side of RTB is highly complex and is comprised of a large number of different factors. Explaining how RTB works deserves a separate post, but in the simplest terms, the RTB process works like this:

- Publishers sell their ad inventory on the ad exchanges.

- Advertisers then bid on the publisher’s inventory in real time, based on the impressions that are valuable to them (audience, retargeting, etc.).

- The winner is the advertiser who bids the highest amount of money for that impression.

- The winning ad is then displayed on the publisher’s website.

The process (also called Programmatic Media Buying) is repeated each time a web page is loaded on a user’s computer. This real-time auction starts and finishes before the page loads and happens in about 100 milliseconds.

What was once used as a way to sell off remnant inventory, RTB is now being utilized for all types of display advertising, including premium ad space.

RTB has completely changed the online display industry for all parties involved. Apart from the obvious benefits (improved targeting and retargeting, higher revenues on impressions, reduced inventory waste, greater control, etc.), RTB also provides a number of advantages through the use of real-time analytics:

For Advertisers

Increase ad effectiveness: An integral part of any campaign run via RTB is campaign-performance analysis. Analyzing the performance of each campaign through real-time analytics enables advertisers to quickly move their focus from one group of ads to another, based on their performance. With RTB, this can be done programmatically, meaning that the changes are done automatically by an algorithm without the involvement of humans. This ability to quickly change focus allows advertisers increase the effectiveness of their ads.

Recognizing fraudulent inventory: Ad fraud is a massive concern in the display advertising industry. It is reported that $6 billion is taken from advertisers through ad fraud each year. Real-time analytics combined with fraud-fighting technologies can assist advertisers in identifying potentially fraudulent inventory (extremely high click-through rates are often a sign of bots at work) and thus reducing the amount of lost revenue to ad fraud.

Campaign optimization: Another key benefit offered by real-time analytics is the possibility to apply advertising strategies and tactics to campaigns to increase their overall effectiveness. Identifying the performance of a campaign, or a number of campaigns running simultaneously, in real time enables advertisers to increase the response rates of specific ads by applying certain tactics. By recognizing in real-time which audiences and ads are producing the best click-through rates, reach, and engagement, advertisers can take action and change the direction of certain campaigns on the fly.

For Publishers

Increased revenues: As a publisher’s inventory is now available to a large number of advertisers, the number of potential buyers is considerably higher. This results in more inventory being sold and at a higher price.

Optimize price floors: Through the use of real-time analytics, publishers can adjust the CPM price floor of their inventory to maximize their revenue by analyzing the real price advertisers are paying for certain audiences. Take, for example, a travel site that sets a CPM price floor of $1.50. By analyzing the going rate for this audience, the publisher may find that many advertisers are paying a CPM price floor of $1.40. The publisher can then make changes accordingly and start earning revenue that otherwise would have been lost.

Ad spending on RTB in the U.S is projected to increase by 31% to $5.94 billion, and account for 25% of all online display advertising sales in 2015 – clear evidence that RTB is shaping the future of display advertising and firmly planting itself in the online advertising industry.

Developing advertising technology solutions is one of Clearcode’s passions. Learn more about how Clearcode’s specialized Ad Tech team can help you plan, design, and build your next RTB technology, DSP, or ad tech solution by visiting our Advertising Technology page in our Offers section.